Recently I’ve become obsessed with bookkeeping and accounting. I’ve always been a numbers guy through and through but hated doing bookkeeping and accounting stuff early on in our business because admittedly we weren’t making much money so there wasn’t much to do and it was just down right depressing seeing more money going out than money coming in.

Once you start making good money it becomes really fun to do bookkeeping and accounting!

At this point I think it’s common knowledge that most businesses fail due to cash flow issues but honestly that saying doesn’t mean a lot to someone who has little to no finance knowledge especially practical knowledge that can be applied to their business.

Disclaimer: I am not a CPA and this is not financial advice, this is purely for educational purposes!

Chart of Accounts

For the sake of time/simplicity I’d like to stick to the common Chart of Accounts that you’ll use on a daily basis as it relates to buying and selling properties, I won’t get into the other expenses and incomes associated with typical businesses or real estate specifically because I believe most of it is pretty straight forward. It is important that you try your best to have a clear exit strategy in place prior to the purchase of a property so when doing bookkeeping it is clear whether the property will be on the Balance sheet or P&L (more on this soon)

COGs (Cost of Goods Sold)

These are Chart of Accounts that will show up on your Profit and Loss statement and will be used to determine your gross profits and ultimately your net income.

Purchase Price

Title Costs

Underwriting Fees

Origination Fees

Labor Costs

Material Costs

Sale Price

All these COGs can be used for properties you are buying and properties you are selling. If you use quickbooks you can categorize these properties using projects for each property which would show you under the projects tab your profit margin for each project you are currently working on.

Fixed Assets

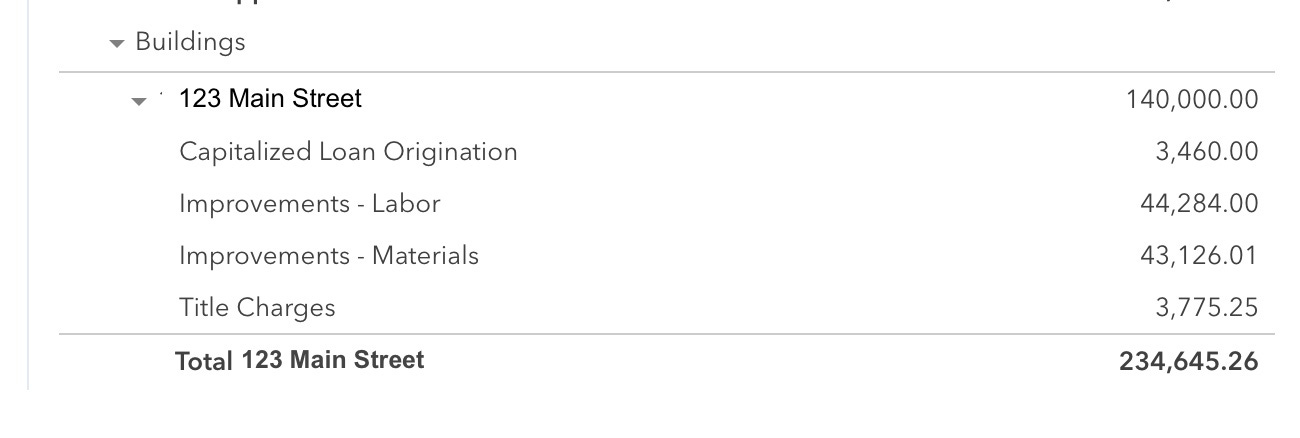

For properties you intend on keeping or refinancing out of you’ll typically add them to your fixed assets on the balance sheet in the form of buildings.

Here’s some chart of accounts for fixed assets

Buildings

Improvements - Labor

Improvements - Materials

Title Charges

Capitalized Loan Origination

Depreciated Amount (sum of depreciation from previous years)

Appliances

Vehicles

Tools

Having these fixed assets separated from in this way is a great way to make your taxes easier for your CPA. They’ll be able to know exactly what how much each portion of the building costs and what was invested so that you can depreciate these fixed assets dependent on their useful life

Current Assets

Bank Accounts

Earnest Money Deposits

Property #1

Property #2

Property #3

Construction Escrow

Property #1

Property #2

Property #3

Current Liabilities

Hard Money Loans

Property #1

Property #2

Property #3

Private Money Loans

Business Credit Cards

Bank Account Setup

Setting up your banks in an organized fashion is crucial to simplifying your bookkeeping and accounting. I’ve met some real estate investors who run everything through one bank account…

If you want to be disorganized and complicate your business finances use only one bank account for all your transactions

For the serious investors you’ll have multiple sub-accounts for all different aspects of your business.

The exact structure and use of your bank account hierarchy so to speak will be largely dependent on your specific business model and your business processes. Here’s some things to think about when setting up your bank accounts.

What are the transactions you do the most of?

Amount your spending for different transaction types

Each account shouldn’t have more than 8 total different categories types

Label/name your different accounts

Example:

Categories of Transactions

Software Subscriptions

Earnest Money Deposits

Interest Payments

Paying Contractors

Collecting Draw Money

Paying for Materials

Funding down payments for Deals

Lawyer Fees

Accounting Fees

Salaries

Income

After seeing all these different categories it’ll become easier to determine what should fall under an umbrella account.

We have about 12 bank accounts under our Chase Business Banking

For simplicity sake I’ll share 2 of our most used bank accounts

Operating Expense

Software Subscriptions

Earnest Money Deposits/Hard Money Deposits

Interest Payments

Lawyer Fees/Accountant Fees

Builder’s Risk Insurance Premiums

OPM (Other People’s Money)

Collecting draws from Private/Hard Money Lenders

Paying Contractors

Paying for Materials

Planning Between Income Statement & Balance Sheet

I recently had a conversation with our CPA when we were filing taxes and we spoke about the importance of how you decide to setup your books and being strategic about that.

Earlier I mentioned why it’s important to have a clear exit strategy in mind when buying properties because that’ll determine how you’ll do the bookkeeping.

Here’s the main difference that you need to understand! You can categorize the purchases of property in a few ways

Properties you Intend on Selling

Inventory: Balance Sheet

COGs: Income Statement

Properties You Intend on Keeping

Fixed Assets

Buildings

Knowing these things are important because when you decide to do the bookkeeping these decisions will affect your Balance Sheet and Income Statement for better or for worse depending on your perspective.

If you place the properties you intend on selling on the balance sheet as inventory that will dramatically increase your net income on the Income statement because it’ll reduce the expense of the purchase price as COGs. With a higher net income on your Income statement you’ll essentially being increasing your taxable income but it will make your income statement and balance sheet look more favorable if you were to want to get a Bank Loan or Business Line of Credit.

Conclusion

This was a very brief overview of the things you should be know about when setting up your books and ultimately creating your strategy for your business finances. I felt that this article was necessary to write not only because I love talking about these things but also because I haven’t met many real estate investors personally who know much about this aspect of the business. A lot of people would rather just outsource and let their bookkeeper decide for them but I believe it’s important to figure things out yourself first and understand the basically before hiring someone to fill that role!